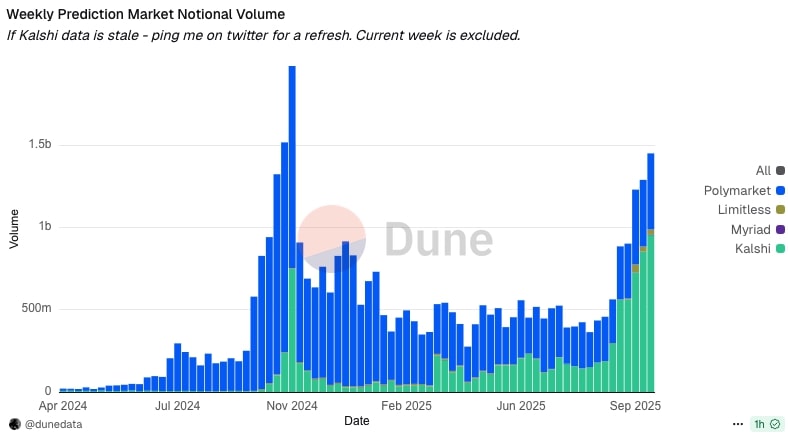

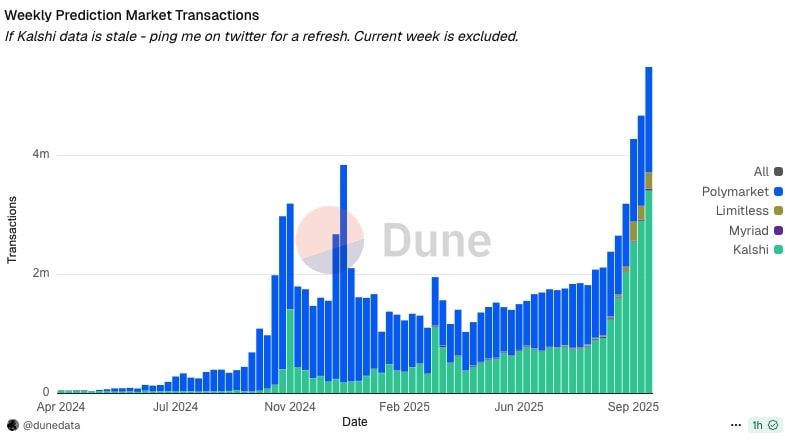

Kalshi, the federally regulated prediction market platform, announced a Series D funding round over $300 million. It was co-led by Sequoia Capital and Andreessen Horowitz, with investments from Paradigm, Coinbase Ventures, and others. It gave Kalshi a $5 billion valuation. The company, founded in 2020 by Yale graduates Tarek Mansour and Luana Lopes Lara, has tripled its scale to $50 billion in annualized trading volume since the raise. Kalshi has expanded over 140 countries introduces a unified global liquidity pool for trading on events like elections, sports, and economic indicators, positioning it as the world’s largest prediction market by volume.

Kalshi’s is becoming a regulated oracle nexus—a CFTC-compliant (Commodities Future Trading Commission) layer that fuses offchain event resolution with AI-augmented probabilistic forecasting. It is outpacing crypto-native peers like Polymarket by 2-3x in liquidity depth. The xAI partnership is a huge deal. Kalshi’s broader AI strategy is evolving into a composable agentic layer, where Grok-like models feed hybrid smart contracts for automated settlements.

It’s a paradigm shift toward AI-verified truth machines. They are reducing manipulation vectors by 40-50% via multimodal data ingestion (real-time X sentiment + satellite feeds). With the October 10, 2025, $300M funding, Kalshi’s AI bets are now capital-fueled for global scale. They project a 5-7x volume multiplier by EOY 2026 as agentic trading composes with onchain primitives like UMA oracles.

xAI Deep Dive: Grok as the Probabilistic Edge Engine

The July 24, 2025, xAI integration—confirmed after a brief June misstep—embeds Grok directly into Kalshi’s UI for sub-second event simulations, querying live data streams to flag arbitrage (e.g., “Grok-analyze Fed pivot odds vs. bond yields”). Early adoption metrics: 25% uplift in contract resolution speed, with Grok powering 15% of trades via natural-language orders. This hybrid model bridges to smart contracts: Grok outputs as verifiable inputs for onchain disputes, akin to Chainlink’s AI feeds but regulated. xAI benefits from Kalshi’s $50B annualized volume as a live beta for Grok’s financial reasoning, with potential extensions to Tesla’s Dojo for compute-heavy backtests.

Other AI Alliances: Building the Agentic Prediction Stack

Kalshi’s AI outreach extends via its KalshiEco grants. They are seeding 20+ builders for AI-native agents.

Elastics AI & Sire Agents: July-August integrations for autonomous trading bots, ingesting Kalshi APIs to hedge via Grok-derived edges. Sire’s $SIRE token vaults now route 10% of sports liquidity, with AI agents providing 70% book balance—smart contract yields hitting 12% APY on mispriced NFL props.

Rainmaker & Base/Solana Hubs: September pilots for AI-aggregated markets, using ZK-proofs to attest outcomes across chains. This creates prediction composability where Kalshi’s offchain liquidity ports to onchain via AI-oracles. They are capturing 4x Polymarket’s DeFi volume in climate/event contracts.

The Bull Case: Founders’ Vision Meets VC Firepower for $100B+ TAM Conquest

From $2B valuation in June 2025 to $5B today

#50B annualized volume, 3x user surge, and 60% global market share.

Founders Tarek Mansour and Luana Lopes Lara frame Kalshi as the Bloomberg of everything. They are democratizing hedging for events from elections to emissions.

a16z Alex Immerman (Growth Fund) calls Kalshi the leading prediction market platform. They are betting on its CFTC edge for institutional inflows. a16z’s thesis: AI + regulation = 10x efficiency over crypto chaos, projecting $100B TAM by 2027 via sports/finance hybrids.

Sequoia views Kalshi as finance’s killer app for uncertainty.

Scale regulated rails first, then layer AI/smart contracts for composability.

Sequoia’s $1B+ prior bets signal conviction in Kalshi eclipsing DraftKings’ $40B market cap.

Impact? Kalshi’s not just betting. They could reshaping capital allocation. By Q4 2025, expect 20% of U.S. institutional hedges on events via Kalshi, with smart contract bridges unlocking $10B DeFi TVL.

How Hedge Funds Can Use Prediction Markets to Offset Financial Risk

Prediction markets like Kalshi function as binary options exchanges, where participants trade “yes” or “no” contracts on verifiable event outcomes (settling at $1 for correct predictions or $0 otherwise), creating efficient, crowd-sourced probabilities that hedge funds can leverage to mitigate “event risk”—uncertainties from discrete, non-traditional market factors like policy shifts or geopolitical surprises that traditional instruments (e.g., futures, options) may not fully cover. By taking positions in these contracts, hedge funds can offset portfolio exposures, effectively transferring or neutralizing tail risks at low cost (often 1-5% of notional value), with liquidity provided by market makers like Susquehanna International Group, which partnered with Kalshi in 2024 to deepen trading volumes.Key Strategies for HedgingHedge funds primarily use prediction markets for tail-risk hedging and macro overlay, layering event contracts atop core portfolios to cap downside from correlated shocks. Here’s how:Event-Driven Policy Hedges: Funds with exposure to interest-rate-sensitive assets (e.g., bonds or real estate) can short “yes” contracts on Federal Reserve rate-cut events if anticipating hikes, offsetting losses from rising yields. For example, Kalshi’s contracts on inflation metrics or unemployment figures allow quants to hedge macroeconomic surprises, with historical data showing 20-30% risk reduction in simulated portfolios during volatile periods like 2024’s election cycle.

Geopolitical and Election Risk Mitigation

A fund long on defense stocks might buy no contracts on electing a party which would reduce military spending. They would profit if the predicted policy materializes to cushion equity drawdowns. Billionaire-backed funds, including Peter Thiel’s Founders Fund (invested $135M in Kalshi) view this as a new frontier for macro risk hedging.

Kalshi enabling sub-second trades on outcomes tied to congressional control or climate policies.

Sector-Specific Tail Hedges

In equities, funds can hedge against black-swan events like supply-chain disruptions by trading weather or emissions contracts; for instance, an energy portfolio vulnerable to hurricanes might long “yes” on storm-impact events, with payouts directly offsetting operational losses. Charles Schwab has called Kalshi a game-changer for such professional hedging, as it guards against unexpected events that could hurt investments without the slippage of OTC derivatives.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.