Amazon shows how capex-heavy bets can terrify investors yet compound into fortunes. From 1997–2003, Amazon had over $5 billion in cumulative losses amid relentless infrastructure spends—warehouses, servers, logistics—totaling ~$10B adjusted, or 5–6x annual revenues at peaks. In 1999, Amazon’s market cap was approximately $25.7 billion, fell as low as $3.6 billion in 2001 and got back to $21 billion in 2003.

Investors feared a death spiral. Stock traded at 100x sales in 1999, then cratered 95% in the dot-com bust, with quarterly losses hitting $1B+.

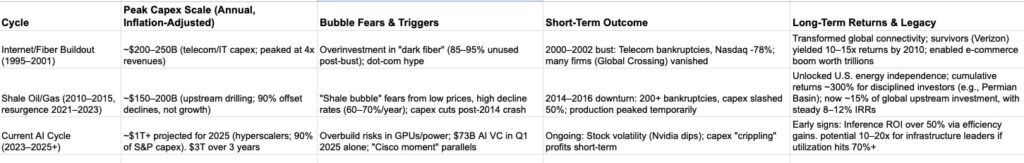

Explosive capex (often 3–4x near-term revenues) driven by technological leaps as seen with fiber and shale oil. It was followed by eventual 20–50% capacity gluts and 30–80% share pullbacks for overleveraged players. Survivors had scale and delivered asymmetric upside. Fiber’s dark fiber now underpin 99% of internet traffic. Shale’s fracking tech slashed breakevens from $60 to $30/barrel and sustain U.S. output at 13M bpd. AI’s edge? It is dominated by seven hyperscalers that have highly profitable businesses.

Bezos prioritized flywheel economics. Capex built moats. By 2003, profitability flipped to $35M quarterly.

In AI terms, today’s $100B+ annual capex (up 50% YoY) mirrors the previous capex heavy shifts.

The AI Cycle: Bigger, Faster, But Smarter?

Today’s AI buildout dwarfs predecessors. Hyperscalers plan $200B+ in 2025 data center capex alone versus fiber’s $150B peak. Many scream that there is a bubble.

AI is more concentrated in the Big tech giants. Microsoft, OpenAI, Google, Amazon, XAI, Nvidia, Oracle, Dell etc…

Utilization fears? Early signs show 60–80% loads in top clusters vs. fiber’s 5–15%.

Power constraints (100GW U.S. demand by 2030) enforce discipline. There could be 5–10x ROI for efficient operators and AI inference could achieve 80%+ margins at scale.

Returns in AI Inference: Nvidia B200’s Game-Changer

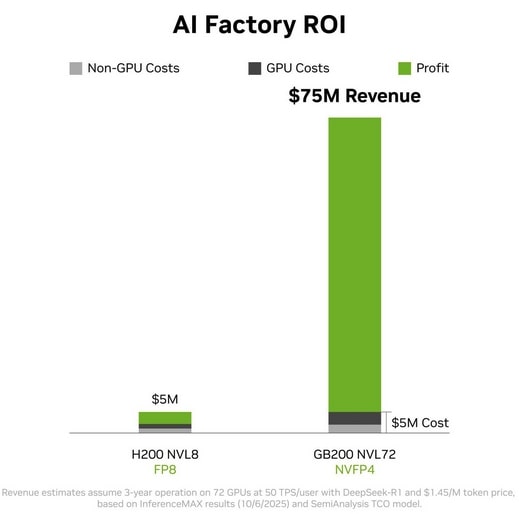

AI inference is when AI is used to deliver answers and value. SemiAnalysis’ InferenceMAX benchmarks show Nvidia’s B200 as a returns accelerator.

TCO per million tokens drops 30–50% for hyperscalers over 4 years ($2–3/hr/GPU), enabling pricing at $0.10–0.50/M tokens while margins hit 60–80%.

There is the potential 90%+ ROI on B200 clusters at 70% utilization. A $40K B200 GPU, deployed in a 1,000-unit cluster ($40M capex), could generate $100M+ annual revenue at $0.20/M tokens and 10B tokens/day—yielding 150% IRR over 3 years, post-opex. This crushes shale’s 8–12% or fiber’s delayed 10x.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.