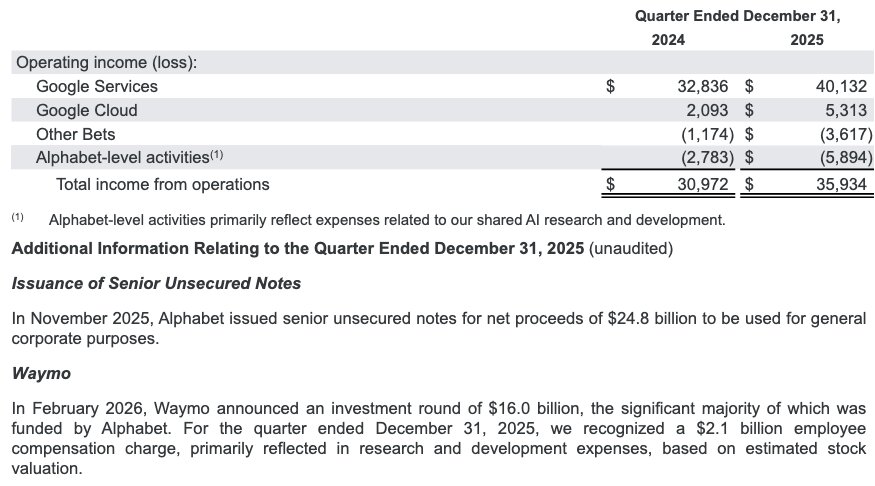

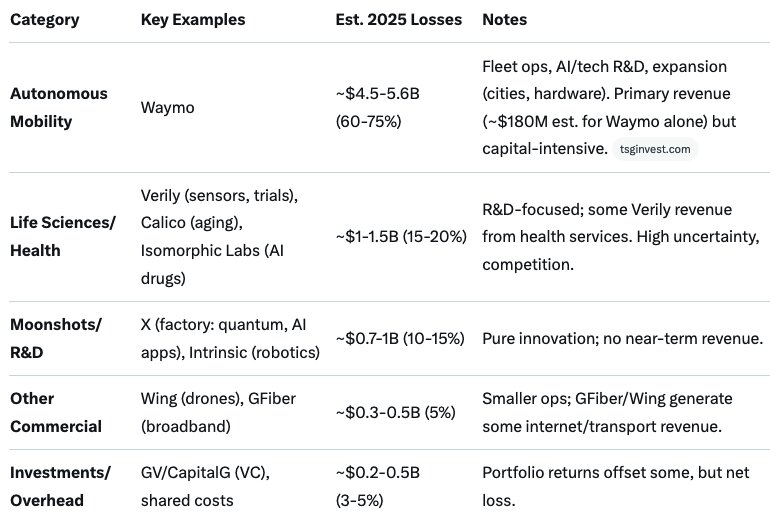

For full-year 2025, GOOGLE Other Bets posted an operating loss of $7.52 billion. This was up ~$3.1B (or ~$3B) from $4.4B in 2024.

Waymp had higher employee compensation (especially a $2.1B one-time stock-based comp charge for Waymo in Q4, tied to its $16B funding round and $126B valuation) plus rising ops/R&D costs from scaling.

Waymo accounts for ~60-75% of the segment’s losses, or ~$4.5-5.6B in 2025 (including the charge). Even without the charge it was $2.4 to $3.5 billion in losses.

Waymo have 15M rides in 2025 for about $270 million in ride revenue in 2025 ($18 per ride). Targeting yearend runrate of 1 million rides per week. Likely, 40-45 million rides in 2026 which is $700-800 million per year.

2025

~-$5B (fleet ops ~40%, R&D ~30%, remote/expansion ~30%). ~$330/ride total burn (high fixed costs).

2026

Costs rise 20–40% (fleet ×2, cities ×3–4), but per-ride drops 30–50% (better utilization).

Net: $4.5B–$6B loss (revenue covers more ops. $16B raise funds capex).

2027

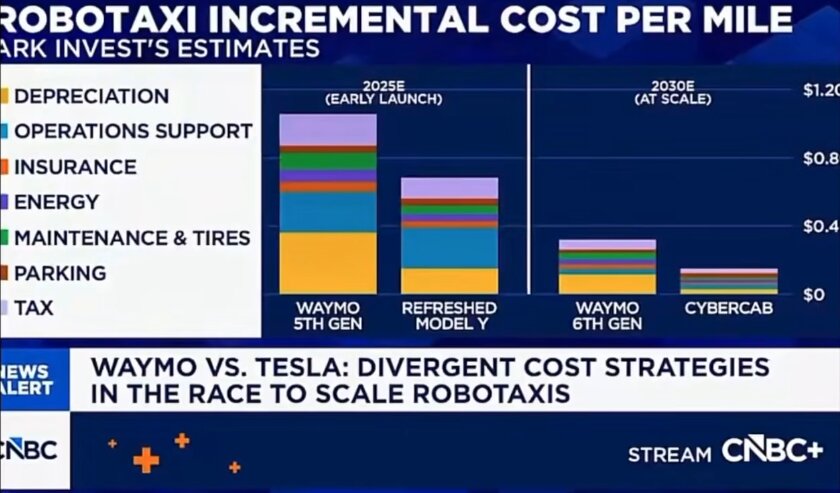

Scale + hardware savings (sensors down 90% since 2017). Need to face no pricing pressure from Tesla.

If Tesla pressures the $1 per mile then Waymo cannot achieve profitability.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.