President Trump mentioned a 15% annual GDP growth target.

Progrowth Policy

Lower interest rates and accommodative monetary policy to boost borrowing, investment, and consumption.

Warsh’s perceived willingness to tolerate stronger growth without quick tightening.

Complementary policies like tax cuts, deregulation, and energy production (drill baby drill) that Trump has long advocated.

Achieving sustained 15% real annual GDP growth would require an unprecedented combination of demand stimulus and supply-side revolution.

Every Policy Would Become Pro-Growth

Monetary Policy Aggressive rate cuts (potentially to zero or below historical norms). Frameworks that prioritize employment/growth over preemptive inflation fighting. Warsh signals tolerance for higher growth.

Extend or expand tax cuts (corporate, individual, capital gains) to boost investment and consumption. Targeted incentives for R&D, manufacturing, and infrastructure. Increased government spending on strategic areas (energy, defense, AI) without excessive waste, though this widens deficits short-term.

Deregulation and Supply-Side Reforms. Rapid rollback of rules in energy, environment, finance, housing, and tech to lower costs, speed permitting, and encourage capital formation. This could unleash private investment and productivity.

Energy and Manufacturing Renaissance. Maximize abundant and cheap energy. Outlier would be space based AI solar power.

Policies accelerating AI, automation, biotech, and advanced manufacturing adoption. Public-private partnerships, immigration reform favoring high-skilled workers, and education/skills initiatives. Cheap energy + tech could drive outsized TFP (total factor productivity) gains.

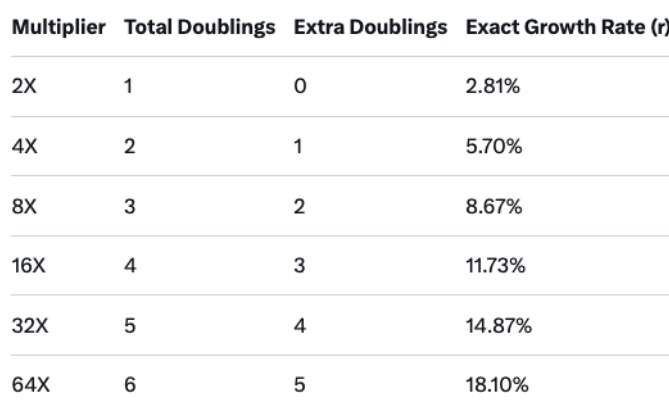

World GDP has been doubling every 25 years for last 100 years even after adjusting for inflation. This means we would be expecting 3 doublings from 2025-2100. However, the world appear to be seeing changing and accelerating technology.

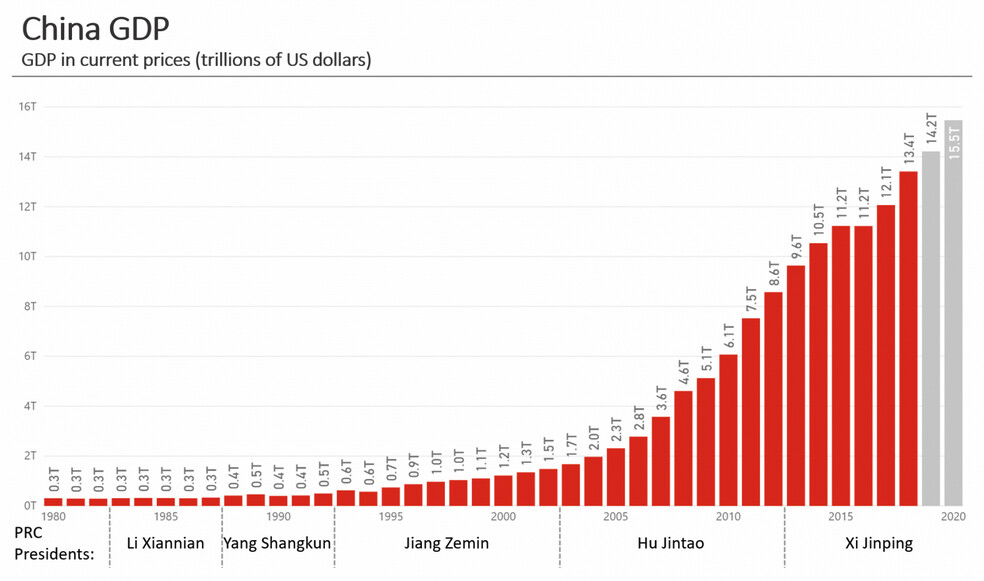

China had sustained GDP growth at high levels after 1978. They had 16 years 1978, 1983, 1984, 1985, 1987, 1988, 1992–1995, 2003–2007, 2010 where there was high GDP growth driven by reforms, exports, and investment. China’s overall average real GDP growth from 1979–2020 was about 8–9%. China’s GDP more than 40X from 1980 to 2020. 40 years for 10 times more growth than a “normal” 4X.

China GDP was boosted by a few hundred billion per year of foreign direct investment.

The US also had a shorter sustained period of high GDP growth. 6 years of 8-19% GDP growth. This was the world war 2 period when the US doubled production. The war mobilization was a huge period a maximum investment and increase in factories and production capacity. It was debt funded at a level of about 20-40% of GDP. There was a smaller and shorter effect for the Korean War.

If the AI data center build and in particular the AI data centers in space enables 100 GW/year and then 100 TW/year of space based solar and billions of chips and satellites for continuing a profitable scaling for decades of AI data centers.

By emulating WW2-era US mobilization but for decades or centuries, where massive investment doubled production, this could drive 18%+ annual real GDP growth. Key enablers include AI-orchestrated roboeverything systems boosting all labor (robotaxis, humanoid bots, automated logistics), digital emulation of white-collar work worth trillions, and accelerated scientific progress.

Elon Musk states full-scale space-based solar AI centers are viable in 2-3 years, powering AI more efficiently than Earth grids.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.